- Latinometrics

- Posts

- 🇦🇷 🔦 Investment Shifts

🇦🇷 🔦 Investment Shifts

Spotlight on Argentina - Day 2: Investment hits new highs, but there's a big catch.

Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

🇦🇷 Latinometrics is in Buenos Aires! 🇦🇷

In honor of this beautiful city, we're publishing a series of special-edition charts about Argentina over the next couple of days.

If you're interested in meeting up with our co-founder, Ernesto Canales, and exploring collaborations, please don't hesitate to drop him an email ([email protected]) or a LinkedIn message.

For our second day: foreign investment in Argentina.

The South Korean Embassy in Buenos Aires, shot from a taxi ride.

🇦🇷 Foreign Investment

There have been quite a few shifts in Argentina's investment landscape recently. For one, Brazil's foreign direct investment (FDI) into the country has tripled in the past two years.

In Q1 of 2022, Brazilian companies injected $435M into the economy and, according to the latest BCRA report, that number surged to $1.44B in the first quarter of 2024, surpassing the US and matching Spain as Argentina's top foreign investor.

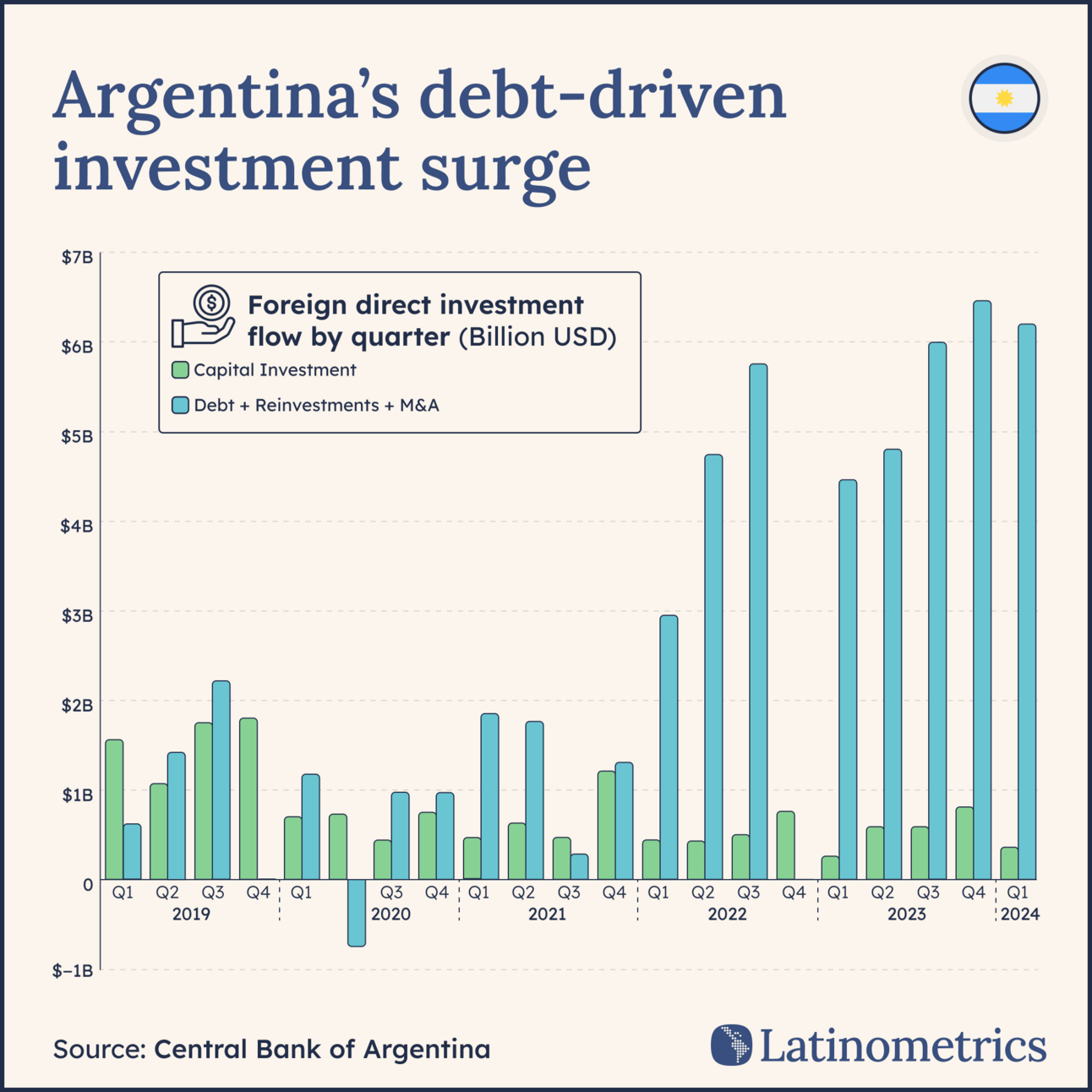

But it's not all rosy. Up until 2021, investments were a healthy mix of debt and capital. The former is arguably preferable as it reflects investments that develop new projects and involves more "skin in the game."

Argentina's debt-driven investment surge

Today, most investments (53%) are in the form of debt, indicating that investors still hesitate to commit with equity or capital in Argentina's economy. In fact, capital investments are just a quarter of what they were five years ago.

But is Milei attracting capital back to Argentina? For the first time in five years, Q1 of 2024 saw an increase (37%) of capital invested compared to the previous year.

And who's leading the capital invested? The answer is much more surprising than Brazil.

Reply