- Latinometrics

- Posts

- 🚗 Car Manufacturing

🚗 Car Manufacturing

Exploring Mexico's key role in North America's car supply chain.

Welcome to Latinometrics. We bring you Latin American insights and trends through concise, thought-provoking data visualizations.

Claudia Sheinbaum has been officially deemed the Trump whisperer.

In office since October, la Presidenta has managed a cool, respectful relationship with her neighbor to the north, US President Donald Trump, in a way which certainly puts leaders in Brussels, Ottawa, or Beijing to shame. And it’s not by accident—exports to the US are hugely important to Mexico’s economy, so each month where she manages to get his threatened 25% tariffs postponed is critical.

Take the car industry, for example. Since the passage of the North American Free Trade Agreement (NAFTA) in 1994, automaking has soared to become the most important manufacturing industry in the country. It contributed a whopping $70B last year, an all-time record.

Cars became Mexico's top manufacturing engine

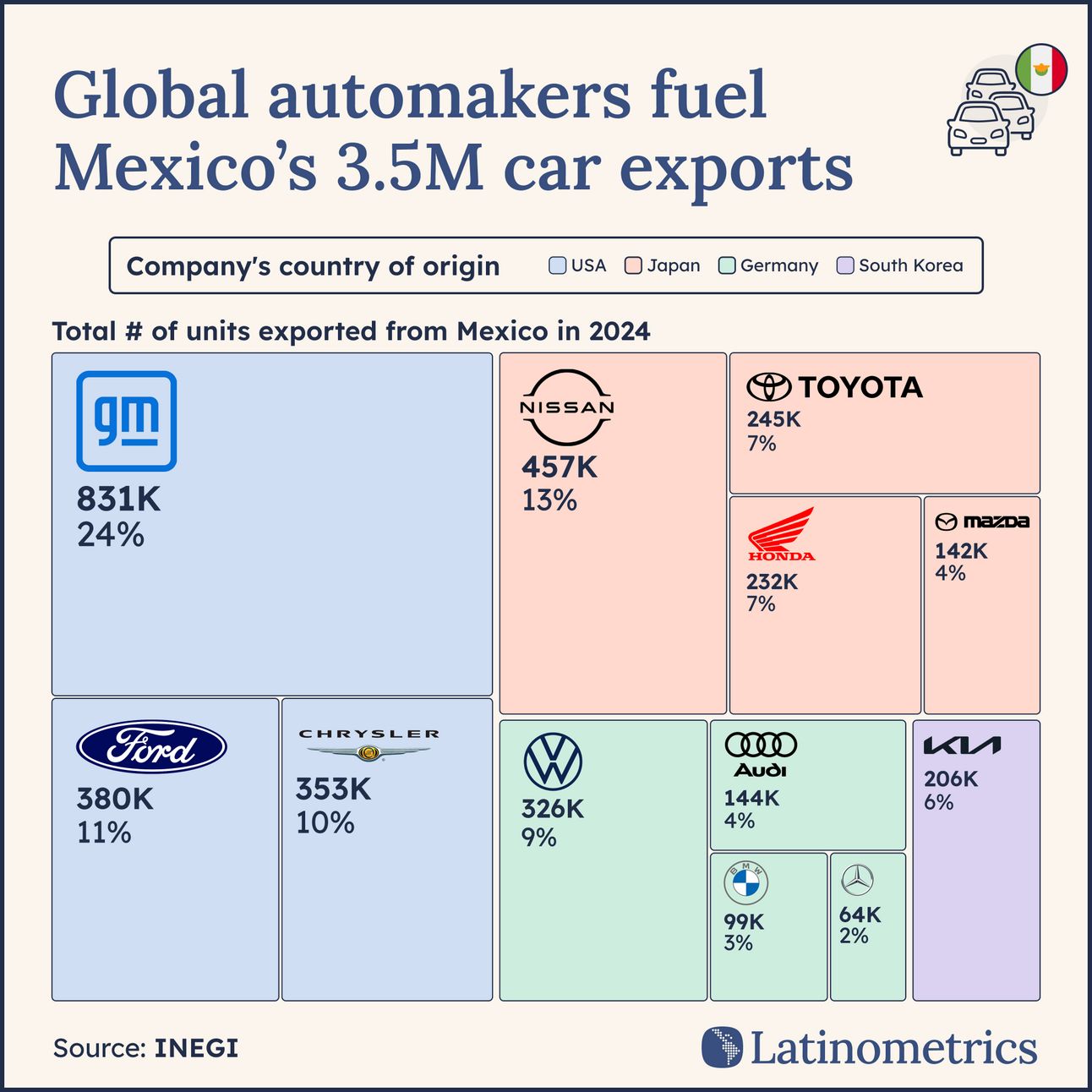

The 3.5M Mexican cars exported last year make the country the seventh-largest auto exporter worldwide, with 80% of these cars heading north to the US. Per Allan Holst Chaires, an economist at Mexico’s central bank, factors such as Mexico’s trade benefits, competitive labor costs, supply chain resilience, and strong international investment all contribute to the country’s powerful export position.

With the imposition of Trump’s proposed tariffs, North American supply chains could be shattered as multinational car manufacturers seek to reduce their exposure. Holst anticipates production slowdowns, job losses, and higher vehicle prices in the US – the last of these to the tune of roughly $6K per car – as a result of the newfound tariffs.

The “pivotal role” of the United States—Mexico—Canada Agreement (USMCA), which replaced NAFTA in 2018 during Trump’s first term, in strengthening Mexico’s automotive sector can be greatly impacted by tariffs, making the negotiations around their imposition highly important to leaders in both the public and private sectors.

Global automakers fuel Mexico's 3.5M car exports

In short, Mexico’s high dependence on the US makes the present moment both delicate and challenging. However, long-term the country’s manufacturing strengths, such as its infrastructure and industrial ecosystem, make it potentially competitive for alternative markets.

“Diversification is challenging in the short term,” Holst acknowledges. With current logistical constraints, car exports to Europe, South America, or the Asia-Pacific region would be hard-pressed to replace the current integrated US-Mexico supply chain.

“However, if tariffs persist, Mexico will need to actively seek long-term trade diversification to reduce dependence on US demand.”

Patricia and Saul weigh in on why they think that low fertility rates might be a good thing.

Feedback or chart suggestions? Reply to this email, and let us know!

Join the discussion on social media, where we’ll be posting today’s charts throughout the week.

Comment of the Week 🗣️